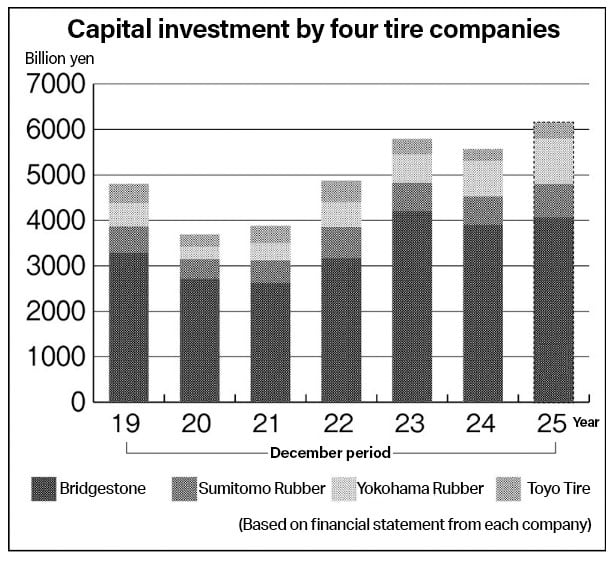

Japanese Tire Makers Invest Aggressively: Four Firms to Surpass 600 Billion Yen

Tires Expand Through Aggressive Investments: Four Companies to Reach 600 Billion Yen, Boosting Production of High-Value-Added Products

Reviewing Unprofitable Businesses and Strengthening Defenses

The total capital investment of Japan’s four major tire manufacturers for the fiscal year ending December 2025 is expected to reach 615.8 billion yen, marking a 10.6% increase from the previous fiscal year. This company-wide investment surge focuses on expanding the production of high-value-added and large-inch premium tires. In the fiscal year ending December 2024, all four companies achieved record-high sales, driven by favorable exchange rates and increased tire sales. Simultaneously, they are working to establish a more efficient and globally competitive structure, reviewing unprofitable businesses and mitigating risks associated with economic fluctuations. By balancing offensive and defensive strategies, they aim to sustain long-term growth.

| Advertisement | |

Investment Strategies of Each Company

Bridgestone plans to invest approximately 406 billion yen in capital expenditures for the fiscal year ending December 2025, a 4.2% increase from the previous year. About 150 billion yen of this will be allocated to strategic investments, including expanding its premium tire business and growing markets such as India and the United States.

The company’s mid-term business plan (2024–2026) sets a total investment of approximately 1.2 trillion yen. While this is a 200 billion yen reduction from the initial plan, it represents a 200 billion yen increase compared to the previous three-year plan. Global CEO Shuichi Ishibashi stated, “We will refine our focus in response to dramatic changes in the business environment.”

Sumitomo Rubber Industries plans to invest 74.2 billion yen in the fiscal year ending December 2025, a 19.3% increase from the previous year. The investment will be evenly split between domestic and overseas operations, with a focus on upgrading facilities to support premium tire production, particularly in Thailand and Nagoya. In January, the company acquired the U.S. trademark rights for the “Dunlop” brand from Goodyear Tire. Sumitomo Rubber President Satoru Yamamoto expressed enthusiasm, saying, “We will accelerate our efforts in the global passenger car market, including Europe, the U.S., and Australia.”

Yokohama Rubber plans a record-high capital investment of 100 billion yen for the fiscal year ending December 2025, a 26.3% increase from the previous year. Of this, 60 billion yen is earmarked for strategic investments—an increase of 67.1%. The company is prioritizing the construction of new passenger car tire factories in Mexico and China. In the off-highway tire (OHT) segment, which serves agricultural and industrial vehicles, Yokohama Rubber completed the acquisition of Goodyear’s tire business for mining and construction vehicles in February. Chairman Masataka Yamaishi emphasized, “We will further enhance our market position and competitiveness in the OHT sector.”

Toyo Tire leads in capital investment growth among the four companies, setting a target of 35.6 billion yen for the fiscal year ending December 2025—a 39.1% increase. Of this, 26.4 billion yen is allocated to its tire business, with a strong focus on introducing cutting-edge manufacturing equipment in the United States.

Risk Mitigation and Business Restructuring Strategies

While increasing investments, all four companies are also implementing defensive strategies, including reviewing unprofitable businesses.

Bridgestone has labeled the fiscal year ending December 2025 as a “year of emergency crisis measures” (according to Global CEO Ishibashi) and is accelerating its business restructuring efforts. In January, the company decided to shut down its La Vergne plant in the U.S., which produces truck and bus tires. In Europe and South America, the company is also restructuring, emphasizing a shift in its business strategy.

Sumitomo Rubber shut down its U.S. tire plant in November 2024 due to declining profitability. The plant, acquired in 2015 as part of Sumitomo’s split from Goodyear, struggled with productivity issues. Moving forward, Sumitomo will focus on importing tires from its Asian manufacturing sites for the North American market. The company expects to save 15.6 billion yen in fixed costs in fiscal 2025 as a result of the closure.

Yokohama Rubber, which holds the largest global market share in agricultural machinery tires, is concerned about its vulnerability to cyclical demand fluctuations. To mitigate risks, it has decided to shut down its Spartanburg, South Carolina plant.

Toyo Tire is restructuring its European sales operations by closing dealerships in Germany and consolidating sales functions in Serbia. President Takashi Shimizu noted, “Turning a profit in Europe is no easy task.” The company expects a 25% decline in aftermarket tire sales in Europe for fiscal 2025 but remains committed to structural reforms.

Additionally, Toyo Tire will transfer its passenger car tire manufacturing subsidiary in China to a local sales partner by the end of June, redirecting resources toward high-growth markets such as North America. While reinforcing their defensive strategies, all four companies remain committed to strategic investments, ensuring sustainable growth with a focus on “quality.”