Seven Passenger Car Companies’ Global Sales Fall 1.4%

Global sales by seven passenger car companies have declined by 1.4%, marking the first year-on-year drop in two years. Intensifying competition in China and North America, coupled with rising sales subsidies, is putting additional pressure on business performance.

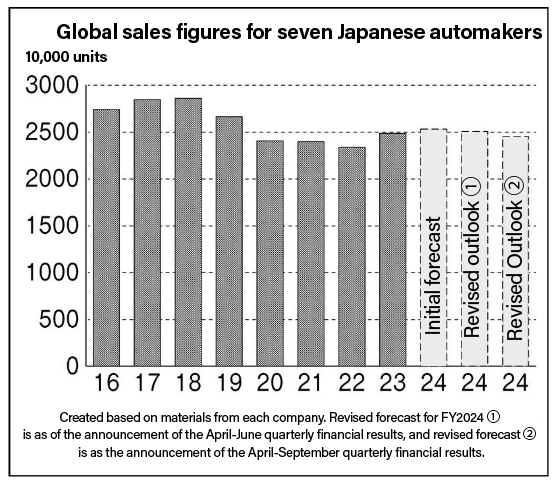

21 November 2024 - Global sales by Japanese automakers are slowing. Seven passenger car manufacturers are forecasting global sales of 24,489,000 units for the fiscal year ending March 2025 (FY24), a 1.4% decrease from the previous fiscal year, marking the first decline in two years. During the announcement of financial results for the April–June 2024 period, a positive outlook had been forecast, but this has now turned negative. Competition is intensifying in key markets, including North America, China, and Southeast Asia. Increased sales incentives aimed at boosting sales are also weighing on business performance. More competitive products and sales strategies are required.

Six companies, excluding Mitsubishi Motors, have lowered their global sales targets for FY24. Nissan Motor and Honda revised their forecasts downward for the second time this fiscal year. Suzuki and Mazda reported smaller year-on-year increases, while Toyota and Honda saw their declines expand. Nissan and Subaru shifted from projecting growth to forecasting a decline compared to the previous fiscal year.

Nissan has reduced its forecast by 250,000 units compared to its earlier projection, with cuts in major regions, including China, Japan, North America, and Europe. In North America, in particular, the company has struggled to capture demand for hybrid vehicles (HVs). “We were unable to sell and earn profits with core models,” said President Uchida Makoto. Rising costs, including increased sales subsidies, are pressuring profits. Addressing the delayed launch of HVs, Uchida added, “It all comes down to whether we can do our best in the market while rebuilding our existing sales and brand power,” highlighting the ongoing challenges.

Toyota lowered its sales target due to production suspensions stemming from certification and quality issues. However, it plans to leverage improvement activities implemented earlier in the year to restore production levels in the second half. Sales expenses are expected to be lower than initially projected, thanks to the strong appeal of hybrid vehicles and the benefits of accumulated initiatives. “In North America, we are able to operate leanly. We will learn from certification and quality issues to strengthen our structure,” said Executive Vice President Yoichi Miyazaki.

Subaru’s Forester SUV and other models remain popular in its key U.S. market, but the company has revised its sales forecast downward, factoring in the balance of current retail and inventory levels, as well as sales incentives. Mazda raised its sales forecast for North America, where it expects record sales driven by the CX-50 SUV and other models, but revised it downward for slower-growing markets, including Japan and the Middle East.

The Chinese and Asian markets are also facing tougher conditions. To address the expanding new energy vehicle (NEV) market in China, Honda has lowered its sales target for the region by 70,000 units. “The decline in sales in China is occurring faster than expected,” said Executive Vice President Shinji Aoyama, adding that the company would consider further fixed-cost reductions.

Suzuki revised its forecasts upward for Japan, where the minicar “Spacia” is performing well, and for Europe, where sales of the compact car “Swift” have increased. However, it revised its forecasts downward for India, reflecting production adjustments made during the first half of the fiscal year. “We are seeing some signs of a slowdown, partly due to the impact of the global economy,” said President Toshihiro Suzuki, referring to Indian sales.

Mitsubishi Motors has kept its sales plan unchanged. The company aims to expand its market share in the Philippines and Vietnam, where the compact SUV “X-Force” is performing well, while strategically investing in sales subsidies in North America to secure volume. “We will respond quickly and flexibly to changes in the environment and strive to achieve our plan,” said President Takao Kato.

#Toyota #Nissan #Honda #Automotive #Mreport #IndustryNews

Source: Nikkan Kogyo Shimbun