Nissan Suppliers Undergo Restructuring to Restore Profitability Amid Prolonged Slump

Amid Nissan’s continued downturn, its key suppliers are now taking decisive action. Unipres and Kasai Kogyo are implementing major restructuring initiatives in China and North America, aiming to turn around earnings and regain competitiveness.

| Advertisement | |

Unipres Consolidates Chinese Operations to Boost Earnings by FY2027

In response to Nissan Motor’s sluggish performance, major suppliers are implementing structural reforms one after another. Unipres, which relies on Nissan for around 80% of its sales, will reorganize its three factories in China and consolidate them into one by fiscal 2025. Kasai Kogyo has reduced its indirect workforce in North America by around 10%. Nissan plans to use the rebuilding of trust with its suppliers as a lever to push forward with cost reforms. However, if the company’s weak performance continues, suppliers may be forced into further restructuring.

Unipres plans to consolidate its production bases for auto body press parts and other products in three Chinese cities—Guangzhou, Zhengzhou, and Wuhan—into its Guangzhou plant during fiscal year 2025. This will result in a reduction of approximately 40% in staff and equipment. The company has positioned this consolidation as a key component of its mid-term management policy for fiscal years 2025–2027. The restructuring of its Chinese business is expected to increase operating profit by 4.5 billion yen by fiscal year 2027. Unipres recorded a reorganization loss of 21.6 billion yen in the fiscal year ended March 2025, primarily due to restructuring in China.

Meanwhile, the company will establish a new entity in Guangzhou in July to leverage its mold technology globally. Additionally, Unipres plans to reduce the total number of employees at its global production bases by 30% by fiscal 2027 compared to fiscal 2020, through the implementation of smart factories and advanced automation.

Kasai Kogyo Cuts U.S. Workforce as North American Losses Deepen

Kasai Kogyo has cut 10% of its indirect workforce—around 500 people—at its U.S. operations. The company’s North American business continues to struggle due to rising costs from inflation and declining sales at Nissan. This restructuring is part of its mid-term management plan, which targets an operating profit margin of 4.5% by fiscal 2027, up from an estimated 0.2% in fiscal 2024.

The company primarily produces automotive interior parts, with sales to Nissan accounting for about 50% of total revenue. In the U.S., Kasai Kogyo operates five factories in Tennessee, Mississippi, and other states near Japanese automaker facilities, including Nissan. North American operations have been significantly impacted by lower production volumes and higher costs for materials, logistics, and labor. As a result, the company posted a cumulative operating loss of over 40 billion yen from fiscal 2020 to fiscal 2022.

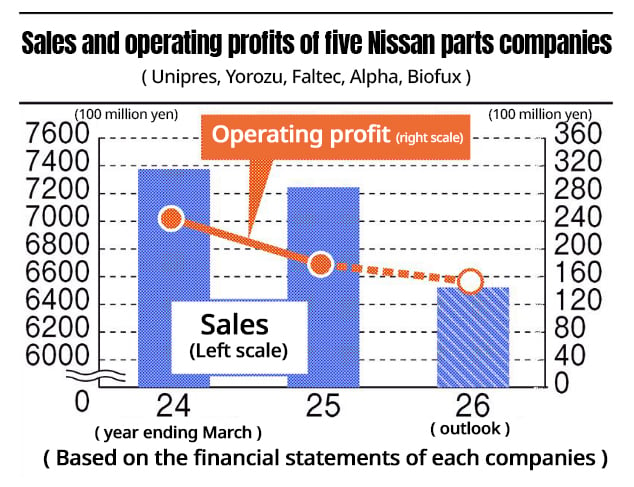

Mounting Pressure on Nissan’s Suppliers as Profit Margins Shrink

Nissan’s management issues directly affect its suppliers. Declining sales and market share in the U.S. and China are squeezing profits. The combined operating profit of five Nissan suppliers—Unipres, Yorozu, Faltec, Alpha, and Prolax—is expected to fall by 26.4% year-on-year to 18.1 billion yen in the fiscal year ending March 2025. Unipres, Yorozu, and Alpha have already posted losses for the current fiscal year.

Looking ahead, the combined operating profit of the five companies is projected to decline further by 15.7% year-on-year to 15.3 billion yen in the fiscal year ending March 2026. The outlook remains bleak, with a continued slump anticipated.

Nissan is undergoing a business restructuring, but it will take time for its performance to rebound. Suppliers are closely monitoring developments. In the meantime, Nissan aims to improve profitability by overhauling its production system and reducing dependency on Nissan by expanding sales to other automakers.

US President Donald Trump has expressed his intention to approve Nippon Steel’s acquisition of US Steel, a major American steelmaker. In a complete reversal of his previous opposition to the acquisition, Trump emphasized that his tariff policy has attracted massive investments from Nippon Steel. However, he has not revealed details such as the percentage of shares to be acquired. A year and a half after the acquisition plan was first announced, the deal is reaching a climax, as Nippon Steel aims to make US Steel a wholly owned subsidiary to facilitate technology transfer.

#NipponSteel #USSteel #Trump #MandA #MadeInUSA #MReportTH #IndustryNews

Source: Nikkan Kogyo Shimbun