Trump Ignites Tariff War: Auto, Steel, and Aluminum Under Fire

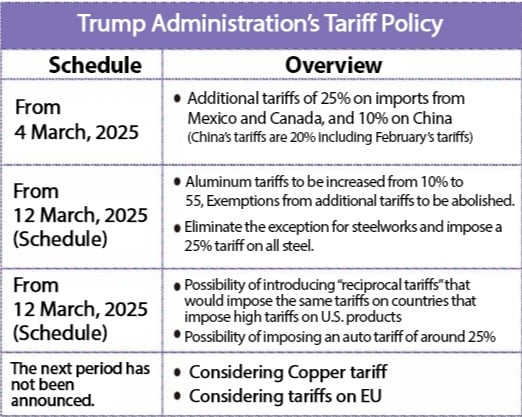

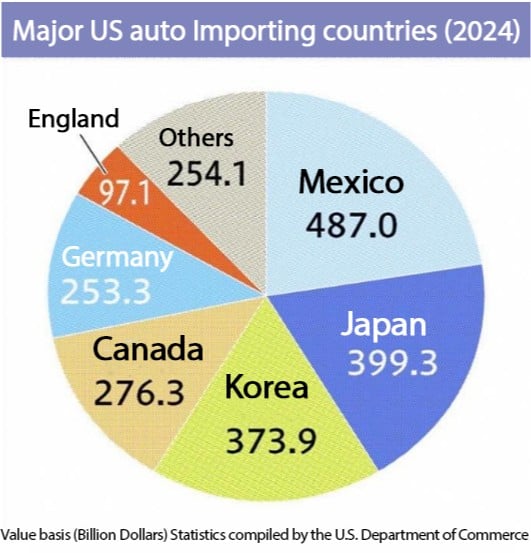

The Trump administration’s new tariff measures on imports from Mexico, Canada, and China officially took effect on March 4 (U.S. time), with a 25% import duty imposed on goods from Mexico and Canada. The move is expected to deal a major blow to U.S. automobile sales.

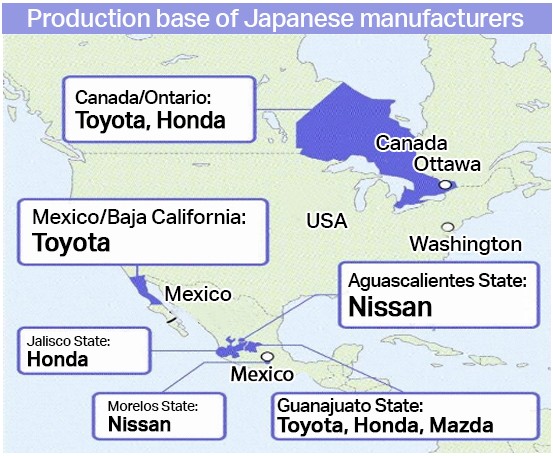

Tokyo – March 6, 2025 – Japan’s automotive industry, which has established extensive supply chains across North America, is now bracing for impact. The Trump administration's protectionist policy is expected to expand beyond current targets, potentially affecting steel, aluminum, and automobiles in the near future. As the effects are likely to ripple across the sector, Japanese automakers are closely monitoring the unfolding situation.

| Advertisement | |

Automakers Consider Vehicle Allocation to Minimize Impact

“There will be some impact on sales, but it’s not something we can control,” said Stanley Electric President Yasuaki Kaizumi with a stern expression. Japan and other countries have built automotive supply chains across the U.S., Mexico, and Canada, leveraging the United States-Mexico-Canada Agreement (USMCA), which allows tariff-free trade under certain conditions. This structure has enabled cost-effective parts production and delivery of high-quality vehicles, supporting strong demand for new cars in North America.

Toyoda Gosei Vice President Hiroshi Yasuda, whose company manufactures airbag components in Mexico, noted, “The Americas account for a large portion of our sales and profits, so the impact will be substantial,” echoing industry-wide concerns.

A representative from a major automaker commented, “There’s no doubt the 25% tariff will have a significant effect. We’re exploring various options. However, even if tariffs rise, we don’t plan to simply raise prices. Our priority is reducing costs to avoid burdening customers.” Still, passing some of the cost to consumers may be unavoidable. Increased vehicle prices could dampen consumer confidence.

In response, companies are urgently seeking ways to lessen the tariff’s impact. Honda Executive Vice President Shinji Aoyama said at a February press conference, “In the medium term, we will consider adjusting the allocation of models and vehicle types.” Bridgestone Global CEO Shuichi Ishibashi added, “We are evaluating multiple scenarios to establish a system that enables rapid response. Still, we will continue to prioritize U.S. production in anticipation of higher tariffs.”

Parts Makers Under Pressure; Production Shifts Not Easily Achieved

If vehicle manufacturers begin relocating production, parts suppliers will be forced to follow suit. Fine Sinter Managing Director Tsutomu Kobayashi stated, “We will closely monitor customer movements, anticipate shifts in production, and build a flexible production and supply system accordingly.”

A senior executive from a mid-sized parts maker remarked, “We’ve recently shifted production from our North American base to Mexico and plan to expand. Depending on the impact of the tariffs, we may consider returning to North America.” Another executive added, “We moved to Mexico due to the USMCA. If tariffs increase, the effect will be severe. We’ve already started discussions with automakers.”

However, shifting production to the U.S. isn’t a simple fix. Parts suppliers cannot relocate operations without the approval of automakers. As NOK President Masao Tsuru pointed out, “Even if we want to move production to the U.S. due to tariffs, the final decision lies with the customer. Our strength lies in offering multiple options and coordinating closely with our clients.”

With rising labor and manufacturing costs in the U.S., some believe it may still be more cost-effective to maintain the current supply chain—even factoring in the 25% tariff. Kazumi Yano, president of TPR, which opened a plant in Mexico in late 2024, commented, “At this point, we’re not revising our Mexico plans. If it becomes feasible to produce in the U.S., we’ll invest there. But relocating production immediately is unrealistic.”

Takashi Kayamoto, Chairman of the Japan Auto Parts Industries Association (NHK Spring), warned, “The USMCA has fostered a tightly integrated supply chain. A shift to U.S. production will reduce domestic output and weaken the overall supply chain, lowering the competitiveness of the entire auto industry.”

Strategic Responses and Long-Term Uncertainty

The imposition of tariffs on Canada and Mexico is undoubtedly a negative development. Possible countermeasures include passing costs on to customers or redirecting products to other markets.

Automakers may try to minimize the impact by exporting Mexico-made vehicles to markets outside the U.S. or increasing exports of Japan-made vehicles to the U.S. However, production must comply with the destination country’s regulations, including laws governing both parts and final vehicle assembly—requiring time and added costs.

It remains unclear how long the tariffs will stay in place. But given the difficulty of fully passing the added costs on to consumers, a significant negative impact on the industry is expected.

#TRUMP #TrumpTariff #MReportTH #IndustryNews

บทความยอดนิยม 10 อันดับ

- ยอดขายรถยนต์ 2567

- 10 อันดับธุรกิจดาวรุ่ง ปี 2568

- คาร์บอนเครดิต คือ

- ยอดขายมอเตอร์ไซด์ 2567

- “ยานยนต์ไร้คนขับ” กับทิศทางการเติบโตในปี 2022-2045

- ยอดลงทุนปี 67 ทะลุ 1 ล้านล้านบาท สูงสุดเป็นประวัติการณ์

- ยอดจดทะเบียนใหม่ยานยนต์ไฟฟ้า 2567

- สถิติส่งออกกลุ่มยานยนต์และชิ้นส่วนไทยปี 2567

- เทคโนโลยีในงานโลจิสติกส์ มีอะไรบ้าง

- 5 เทคนิค “มือใหม่ใช้เครื่อง CNC”

อัปเดตข่าวทุกวันที่นี่ www.mreport.co.th

Line / Facebook / X / YouTube @MreportTH