Nissan’s Bold Restructuring Plan: Cutting Costs and Aiming for Growth

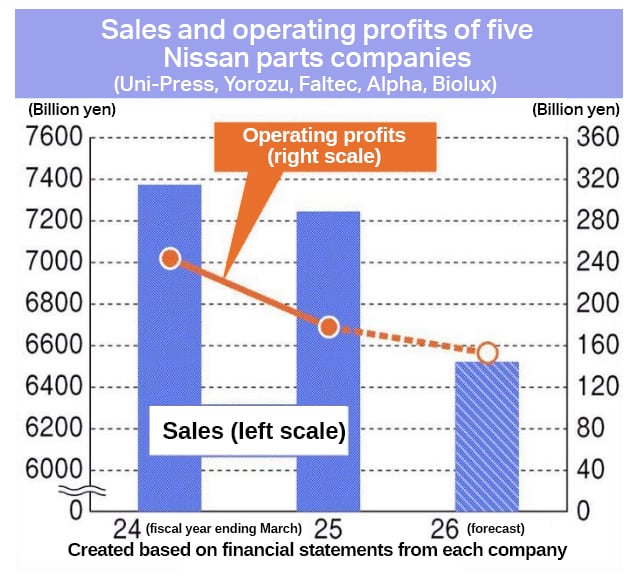

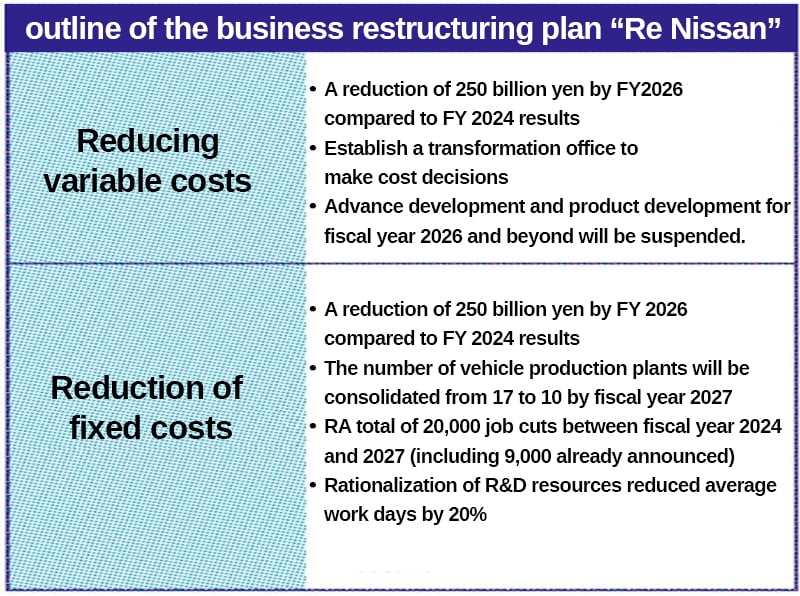

Nissan Motor is shifting gears with a bold counterattack. Its business restructuring plan, known as “Re-Nissan,” involves closing seven factories worldwide and cutting 20,000 jobs, while also aiming to rebuild stronger relationships with suppliers. Despite years of poor performance and repeated restructurings, can Nissan execute this latest plan and get back on a growth trajectory? “If we don’t act now, the company could go bankrupt within two to three years,” warned President Ivan Espinosa, who is resolutely committed to rebuilding Nissan.

| Advertisement | |

Interview with Nissan Motor President Ivan Espinosa: Clear Goals and a Renewed Vision

Q: What is the progress of the restructuring plan?

A: “The goal is clear. It would be irresponsible to blame employees, local communities, governments, or suppliers. We must focus on rebuilding Nissan as a whole.”

Q: What do you see as the root cause of Nissan’s poor performance?

A: “The problem dates back a decade. At that time, management invested heavily assuming growth would come. They expanded supplier networks aiming to reach global sales of eight million units rapidly but failed. The market is tougher than ever. We remain stuck at that eight-million-unit threshold and cannot sustain it. Reassessment is the only way to secure Nissan’s future.”

Q: What is your product strategy going forward?

A: “We are rethinking how we do business. For too long, we adhered rigidly to our internal standards. But the market, technologies, materials, and assembly methods have all evolved. We need to collaborate with our suppliers and learn from them. Together, we can improve competitiveness and efficiency while building win-win partnerships.”

Q: What is your stance on fundraising and asset sales, such as your headquarters?

A:“We have sufficient cash reserves. The key issue is our ability to generate cash going forward. We are focused on improving cost competitiveness and cash flow, and carefully considering future cash use. Nothing has been decided about asset sales.”

Q: What are your management goals post-restructuring?

A: “My dream is for Nissan to become Japan’s leading manufacturer of ‘intelligent cars’ — vehicles that use autonomous driving and other technologies to deliver comfortable mobility. We possess software, driver assistance, and electrification expertise, alongside strong development, production, and sales capabilities. These are our competitive weapons. But first, we must address current challenges. The rebuilding will take approximately 18 months before we can focus on future planning.”

Strengthening Supplier Cooperation and Technological Capability

Nissan is overhauling its supplier strategy, emphasizing dialogue and joint technology development. President Espinosa told about 400 suppliers in May, “Previously, we acted as if we knew more about products and technology than our suppliers. That’s changed. Our suppliers have much expertise, and if their proposals help us compete better, we want to hear them. This new approach aims to create long-term, collaborative relationships.”

As part of “Re-Nissan,” the company plans a 70% reduction in parts variety and nearly halving its platforms from 13 to 7, alongside supplier consolidation — a move causing concern among some suppliers. Reduced order volumes have increased costs for suppliers, adding pressure. Espinosa says, “We will set realistic production targets, reduce the number of suppliers to boost order volumes per supplier, and improve cost structures mutually.” Nissan is also revising internal standards and bringing together multidisciplinary manufacturing teams.

For suppliers, Espinosa highlights quality, cost competitiveness, delivery timeliness, and especially “the way of dialogue.” He stresses the importance of early-stage joint technological development, aiming for a competitive edge through close, long-term collaboration.

Urgent Revamp Needed for China Business Amid Intensifying EV Price Competition

Espinosa offers a sobering assessment of the Chinese market: “No one expected Chinese automakers to rise so fast. This has made our growth plans much harder.” According to the China Association of Automobile Manufacturers (CAAM), car sales in China rose 4.5% in 2024 to 31.4 million units, driven by government support for new energy vehicles (NEVs) and a 65% market share held by domestic brands.

In contrast, Nissan’s 2024 China sales are expected to fall 12.2% year-on-year to 696,631 units — less than half the peak of 1.56 million units in 2018 — and are forecast to drop further by 18.2% in 2025. May sales fell 9.7% year-on-year, marking 14 consecutive months of declines.

To combat this, Nissan launched the new EV “N7,” its first model on the new modular architecture developed with Chinese joint venture Dongfeng Nissan. The N7 offers a maximum range of 635 km and features advanced driving assistance “Navigate on Autopilot,” co-developed with Chinese autonomous driving startup Momenta. By leveraging local suppliers and shortening development time, the N7 is competitively priced from 119,900 yuan (approx. 2.38 million yen), attracting young and family buyers, with sales exceeding expectations.

However, price competition in China is intensifying. BYD recently cut prices on key EV models, followed by other Chinese manufacturers like Geely Automobile. Nissan plans to use China as an export hub but urgently needs to rebuild its Chinese business to remain competitive.

Source: Nikkan Kogyo Shimbun