Japanese Tyre Manufacturers Boost Investment, Ramp Up Premium Tyres to Meet Rising Demand

Four tyre companies' capital investment increased by 7%, expanding high-value-added products responding to increased demand through structural reforms and accelerating development for EVs

| Advertisement | |

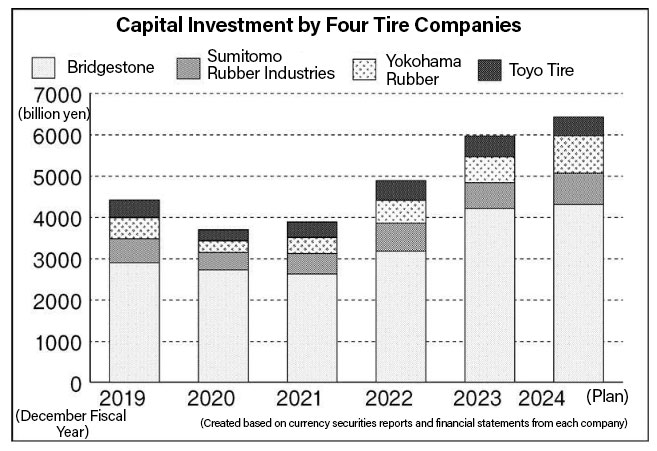

28 Feb 2024 The total amount of capital investment by four domestic tyre manufacturers for the fiscal year ending December 2024 is expected to be 642.1 billion yen, an increase of 7.8% from the previous period.

In addition to tailwinds such as a recovery in supply from completed car manufacturers as the semiconductor shortage eases and the effect of the weaker yen, tyre demand continues to recover, mainly in Europe and the United States, and the business performance of each company will remain strong. As the soaring prices of raw materials and sea freight seem to be coming to an end, they will accelerate to expand sales of high-value-added products and respond to increases through capital investment and structural reforms.

Bridgestone plans to invest 430 billion yen

Bridgestone plans to invest approximately 430 billion yen in capital investment for the fiscal year ending December 2024, an increase of approximately 3% from the previous fiscal year. Approximately 40% of this amount (165 billion yen), will be allocated to strategic investments. The premium tyre business, which accounts for over 60% of consolidated sales, will be strengthened. Global CEO Shuichi Ishibashi said, “We will continue to bring the best products in 2024,” and will continue our “premiumization” by strengthening sales of high-value-added products such as high-inch tyres and tyres for electric vehicles.

On the other hand, the company’s European and American operations in the previous fiscal year still faced issues such as a decline in sales due to sluggish demand for truck and bus tyres. Global CEO Ishibashi says the company plans to “regain Bridgestone’s strong ability to respond to change” by rebuilding its business in the region, including dispatching personnel from Japan.

Sumitomo Rubber Industries plans to invest 75.8 billion yen

Sumitomo Rubber Industries plans to invest 75.8 billion yen in capital investment for the fiscal year ending December 2024, an increase of about 20% from the previous year. Of this amount, 46.3 billion yen will be allocated to overseas investment to improve production capacity for high-performance tyres.

The North American business, which is positioned as the “first stop for structural reform” (Sumitomo Rubber Industries President Satoru Yamamoto), had strong sales in the previous fiscal year but will continue to improve productivity by sending human resources from Japan to production areas.

Yokohama Rubber plans to invest 91 billion yen

Yokohama Rubber’s capital investment plan for this fiscal year ending December 2024 is 91 billion yen, an increase of approximately 45% from the same period, making it the fastest-growing company among the four companies. Of this amount, strategic investment will amount to 56 billion yen, approximately 2.3 times the previous amount, and will be used to increase production in India and the Philippines. In the new three-year medium-term management plan, ending in December 2026, the cumulative strategic investment amount for the three years has been set at 220 billion yen.

Under the new medium-term plan, to respond to cost competition in the ever-growing Chinese and Indian markets, the company will promote the “One-Year Factory” initiative, which aims to launch a low-cost, high-efficiency factory within one year.

Yokohama Rubber President Masataka Yamaishi said, “We will work to speed up tyre development. Shinji Kiyomiya, the next president (scheduled to take office on March 28), will take the lead, “We have high hopes for our next president, Kiyomiya, who has a wealth of knowledge and know-how in the production and technology fields.

Toyo Tyre plans to invest 45.3 billion yen

Toyo Tyre’s capital investment for the fiscal year ending December 2024 is planned to be 45.3 billion yen, down about 10% from the previous year. Among the four companies, the company is the only one expected to see a decrease in sales, but it will increase production capacity for large-diameter tyres in the United States to meet demand in the North American market, which is expected to continue to perform well as in the previous fiscal year. In addition to bringing the Serbian factory to full production, the company will take steps to improve profits.

Toyo Tire President Takashi Shimizu said the company will “flexibly respond to (changes in the market)” by leveraging its strengths in areas such as tires for sport utility vehicles (SUVs) and the breadth of its lineup.

Summary

Each company is developing tyres for electric vehicles (EVs) as part of its efforts to expand its lineup of high-value-added products. It has been pointed out that the EV market is slowing down, especially in Europe and the United States, but Yokohama Rubber President Yamaishi emphasized that there is “no impact”, citing examples of transactions with overseas vehicle manufacturers.

#Bridgestone #SumitomoRubber #YokohamaRubber #ToyoTyre #อุตสาหกรรมยางรถยนต์ #Mreport #ข่าวอุตสาหกรรม

บทความยอดนิยม 10 อันดับ

- ยอดขายรถยนต์ 2566

- คาร์บอนเครดิต คือ

- อบรมรถยนต์ไฟฟ้า 2567

- Apple ครองตลาดสมาร์ทโฟนพรีเมียมในปี 2023

- การเปลี่ยนแปลงของเครือข่ายไร้สาย 5G

- ยอดจดทะเบียนรถยนต์ไฟฟ้า 2566

- สถิติส่งออกกลุ่มยานยนต์และชิ้นส่วนไทยปี 2566

- เทคโนโลยีในงานโลจิสติกส์ มีอะไรบ้าง

- กฎหมาย ปล่องระบาย อากาศ

- solid state battery คือ

อัปเดตข่าวทุกวันที่นี่ www.mreport.co.th

Line / Facebook / Twitter / YouTube @MreportTH