Toyota Posts Strong Profits Amidst Challenges

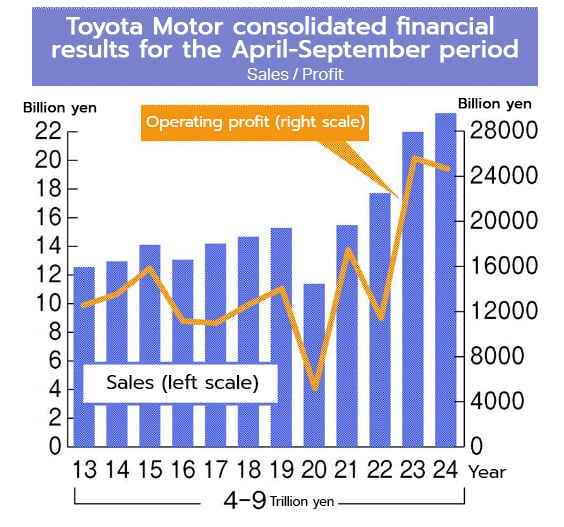

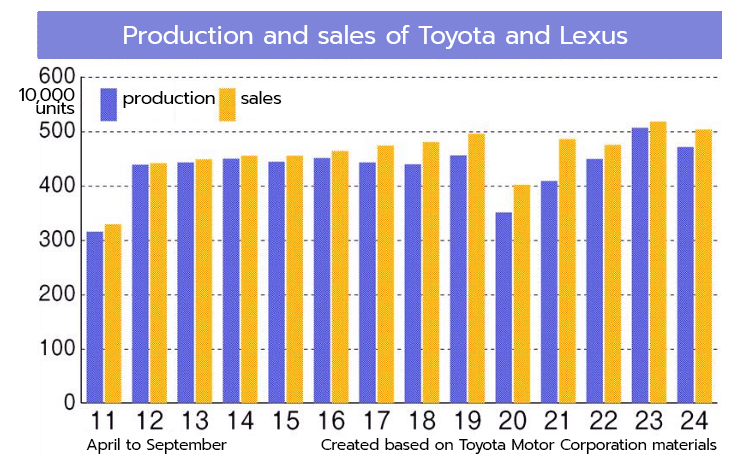

Toyota overcomes headwinds to maintain profitability, steady cost reduction activities and other efforts resulted in an operating profit of 2.4642 trillion yen for the April-September 2024 period, matching the same period last year. Production declined due to certification issues and recalls, but the company maintained sales volume by introducing region-specific vehicles through product-centered management.

- Seven Passenger Car Companies’ Global Sales Fall 1.4%

- Japanese Automakers Rethink China Strategy Amid Slow Response to NEV Price Wars

Japan, November 7, 2024 - Toyota designated this fiscal year for "solidifying its foothold" and "creating spare capacity," and positive results are now evident. The company plans to increase its production pace in the second half of the year.

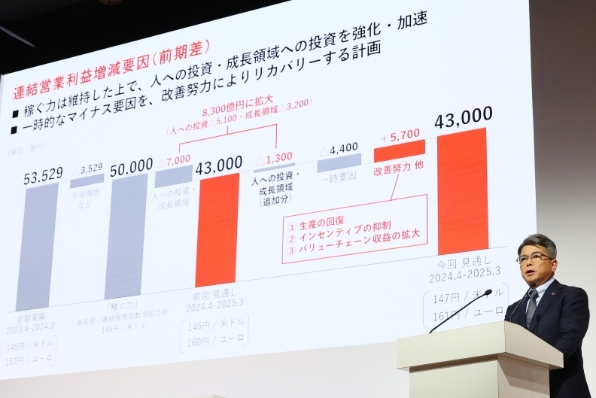

Vice President Miyazaki's presentation (Tokyo, Shibuya-Ku, 6th)

Global Electric Vehicle Sales Hit Record High of 2,231,000 Units

"We keenly felt our responsibility to steadily proceed with our production plans. We want to reassess our position and use this opportunity to grow together with our suppliers," said Executive Vice President Yoichi Miyazaki at a press conference in Tokyo on the 6th, voicing his views on the April-September 2024 period. The first half of the year presented challenges, with production numbers declining due to the certification issue. However, operating profit and other profit levels were the second highest in the first half of the year, following the April-September period of 2023. This demonstrates the company's "power to earn money."

Total vehicle sales, including Toyota and its luxury brand Lexus, decreased by 2.8% from the same period last year to 5,029,000 units. This represents a decrease of approximately 150,000 units from the record high achieved in the first half of fiscal 2011. Of these, global sales of electrified vehicles, including hybrid vehicles (HVs) and electric vehicles (EVs), increased by 22.2% to 2,231,000 units, a record high. This figure accounts for 44.4% of the total number of vehicles sold. Toyota's HVs are in high global demand, with sales increasing by 22.6% from the same period last year to 2,077,000 units. EVs also saw a significant increase of 32.5% to 78,000 units.

Steady Implementation of "Investment in People"

In terms of the components that make up operating profit, 210 billion yen was freed up through cost improvement efforts. Toyota has set an annual cost reduction target of 300 billion yen. This exceeded the half-year target of 150 billion yen. Additionally, 610 billion yen was added due to the impact of exchange rate fluctuations, and 80 billion yen was added through sales efforts. Meanwhile, the impact of vehicle numbers and model mix had a negative effect of 140 billion yen.

Furthermore, investments in growth areas and "investment in people" to support suppliers and dealerships will be recorded as a reduction in profits. However, Accounting Manager Yamamoto Masahiro stated, "We are making steady progress," and expressed his intention to grow together with suppliers and other stakeholders.

By region, operating profit in Japan was 1,5245 trillion yen, down 59.9 billion yen from the same period last year due to sales volume and the strengthening of the supplier base. North America saw a decrease of 234.4 billion yen due to a decline in sales volume and increased labor costs. Cost improvements and other factors proved effective, leading to an increase of 31.2 billion yen to 223.5 billion yen in Europe and an increase of 75.4 billion yen to 486.9 billion yen in Asia.

In China, Toyota and Lexus sales fell by 13.7% year-over-year, and operating profits also declined due to increased sales expenses. Price competition is intensifying in the Chinese market, but Vice President Miyazaki stated, "Even in tough conditions, we will maintain sales levels on par with those of local Chinese manufacturers. It's tough, but we're holding our own."

The company maintained its consolidated earnings forecast for the fiscal year ending March 2025 with sales and profit items unchanged. It revised down its Toyota/Lexus sales forecast from 10.4 million units to 10.1 million units, factoring in a decline in sales in the first half of the year.

Establishing a Strong Foothold and Creating Capacity: Building a Foundation for Challenges

Toyota has set the fiscal year ending March 2025 as a period for solidifying its foothold and building up capacity. It views these efforts as essential for transforming into a mobility company, re-examining quality, responding to electrification and intelligence, and rebuilding its supply chain.

Specifically, we are redefining the nature, speed, and quality of work in all industries, including production and development. We are also improving our employees' working environment, employment system, wages, human resource development, and employee benefits, creating an environment where they can feel at ease as they take on the next challenge.

Toyota has announced that it will further strengthen this foothold. It had previously announced that it would invest 380 billion yen to support suppliers and dealers, but has now increased this to 130 billion yen. Combined with an investment of 320 billion yen in growth areas, this brings the total to 830 billion yen. Executive Vice President Miyazaki stated, "While maintaining our earning power of 5 trillion yen, we are accelerating investment in people, including suppliers and dealers. We will build up another step."

In terms of actual activities, first of all, they will promote the shortening of lead times throughout the company. "We will eliminate waste, eliminate rework, and make it possible for anyone to do it," said Vice President Miyazaki. To this end, they will improve the environment at production sites, such as by providing support for the transportation of heavy parts. They also emphasize that they will "increase the "net rate," which is the proportion of work that is truly meaningful and increases added value." They will review the specifications of cars that do not lead to sales, optimize development efficiency, and change parts storage areas into vehicle production spaces.

Although Vice President Miyazaki stated that "activities have just begun in Japan," these efforts have increased annual production capacity by 80,000 vehicles and freed up development man-hours and equipment for three full model changes. Toyota has 54 completed vehicle plants around the world, and plans to expand these activities globally to make them a driving force for further competitiveness.

Thanks to these effects, the company will begin to recover production in the period from October 2024 to March 2025. Domestic production volume will increase from 1.53 million units in the April-September period to 1.75 million units in the second six months of the year. Vice President Miyazaki stated the policy of "utilizing the foundation for Toyota-style car-making that we have regained," and said, "We will return annual production volume to a pace of 10 million units." While restoring production volume, the company will also work to solidify its foothold and create spare capacity.

HV Supports "Earning Power"

Hybrid vehicles (HVs) are supporting Toyota's earning power, even as it adapts to various changes in the environment. Sales are going well worldwide. HVs are not only supporting current profits but are also becoming increasingly important for earning capital for next-generation areas such as EVs, on-board batteries, and SDVs (software-defined vehicles).

North America is a market where HVs are performing well. The popular sports utility vehicle (SUV) "RAV4" and the mid-size sedan "Camry" sold about 523,000 units in the April-September 2024 period, up 41.9% from the same period last year. In Europe, the compact HV "Yaris" and compact SUV "Yaris Cross" are also performing well. Sales are expected to increase by 12.4% to about 387,000 units. Vice President Miyazaki reflected, "Our inventory level is about half that of (gasoline vehicles). We are still not able to deliver to customers in a timely manner," but also expressed confidence, saying, "They have become a popular product." In terms of profits, HVs are comparable to gasoline vehicles and are a major factor in boosting business performance.

#Toyota #HVs #EVs #ElectricVehicles #Automotive #Mreport #IndustryNews

Source: Nikkan Kogyo Shimbun