Honda and Nissan Merger to Challenge EV Competition

Honda and Nissan are exploring a merger to bolster their competitiveness in the rapidly evolving automotive industry. The partnership aims to accelerate investments in electric vehicles (EVs) and intelligent technologies, streamline production costs, and foster global collaboration to meet changing consumer demands.

| Advertisement | |

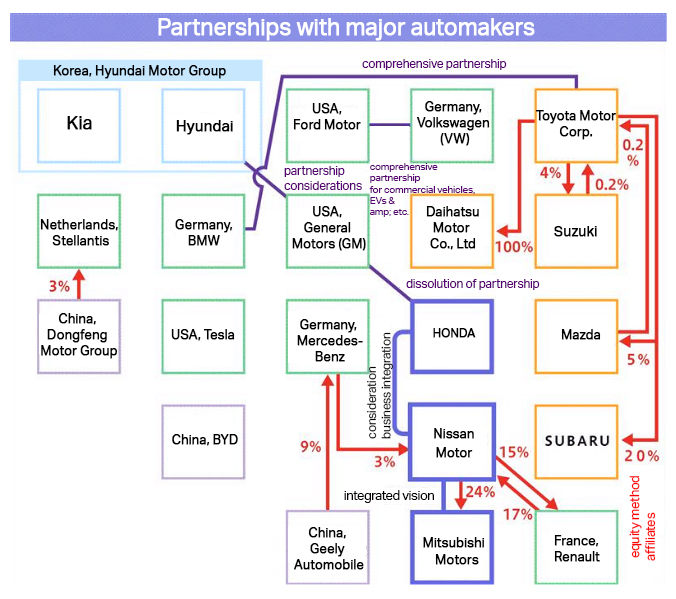

Japan, December 19, 2024 - Honda and Nissan are entering into negotiations to merge their businesses. Although the collaboration was only announced in August, Nissan, which has been experiencing sluggish sales, is taking it a step further under pressure from external sources. What drove these two companies, which have different corporate atmospheres and cultures, was the changing industrial environment surrounding the automotive industry. Competition with emerging manufacturers such as America's Tesla and China's BYD is intensifying, and there is also an urgent need to respond to software-defined vehicles (SDVs). In recent years, partial alliances to complement each other's technologies have been the mainstream in the restructuring of the automotive industry, but the idea of a "10 million car club" to maximize profits through scale expansion is being rekindled.

Investing in Electrification to Increase Competitiveness

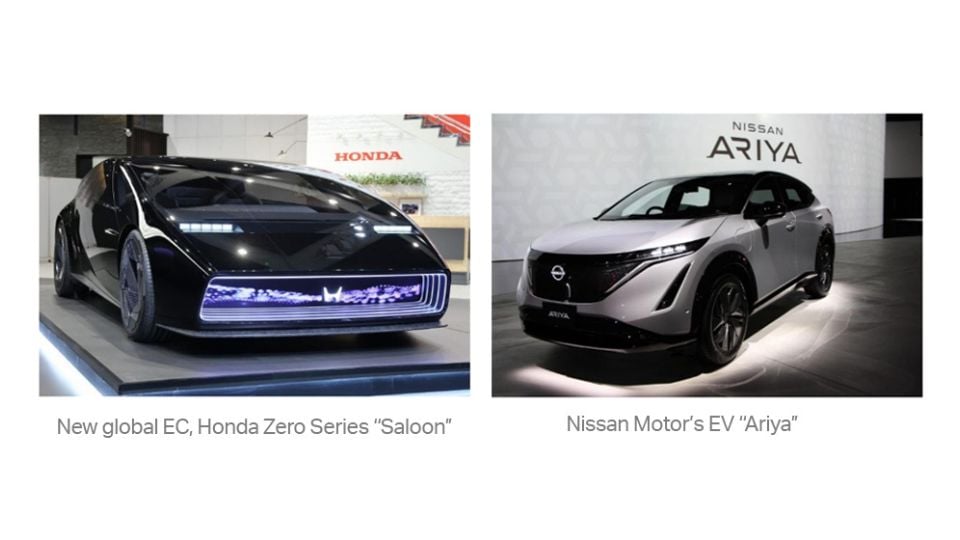

One expected effect of the integration is investment optimization. Electrification and intelligence are key to the competitiveness of next-generation automobiles, and huge investments are essential. Honda plans to invest 10 trillion yen by fiscal 2030, while Nissan plans to invest 2 trillion yen by fiscal 2026. Since beginning discussions on the collaboration in March, the two companies have been discussing standardization and mutual supply of core components for electric vehicles (EVs). As the value of automobiles shifts from hardware to software, it is also crucial to speed up the development of SDVs.

Honda plans to build a vehicle assembly plant and battery plant exclusively for EVs in Ontario, Canada, aiming to start operations in 2028. It is hoped that if the two companies can pool their knowledge and make investments more efficient, they will be able to reduce the burden on management and accelerate development. "There is a demand for greater efficiency in development and investment. It would be desirable from the perspective of strengthening competitiveness to have the two companies work together," said a government official.

While various approaches are being considered toward achieving carbon neutrality (virtually zero greenhouse gas emissions), Honda is aiming to achieve a 100% sales ratio of EVs and fuel cell vehicles (FCVs) by 2040. It seems that two companies will be able to complement each other in terms of powertrains (drive systems), as Nissan aims to offer a balanced product lineup. Honda has strengths in the light vehicle "N-BOX" and Nissan has the minivan "Serena." Synergy is expected in the vehicle model lineup as well.

Issues Surrounding the Consolidation of Overseas Bases

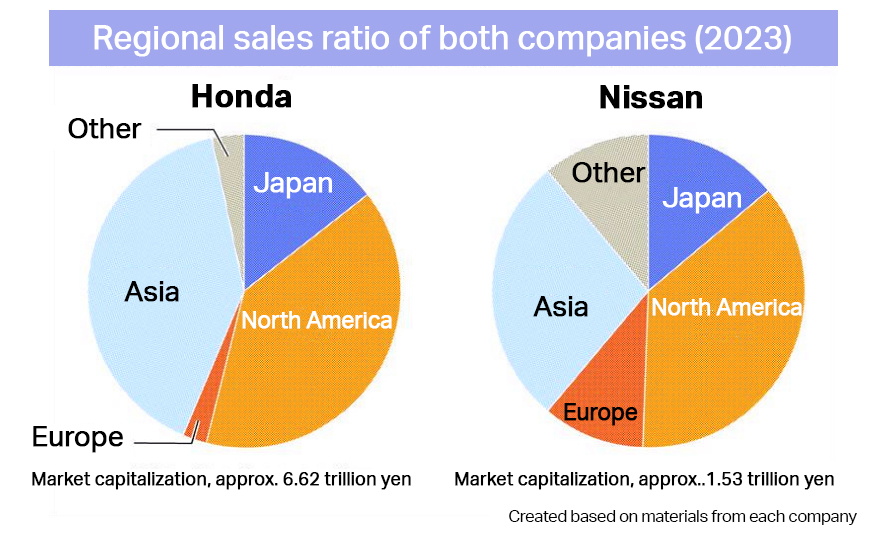

On the other hand, there are many challenges to overcome in order to integrate management. Both companies focus on the Japanese market, as well as North America and Asian markets, including China. Each has its own manufacturing base and sales network. Amid intensifying competition with emerging manufacturers, the company is carrying out restructuring in China and other regions, but it is inevitable that it will have to streamline its workforce in overlapping regions and consolidate and close bases in the future.

Above all, Nissan is in the midst of a slump in performance. In the consolidated financial results for the April-September period of 2024, operating profit decreased by 90.2% compared to the same period last year. The company has announced plans to cut 9,000 jobs, equivalent to just under 10% of its global workforce, and reduce its global production capacity by 20% by fiscal 2026. The company also announced executive personnel changes that will result in changes to the responsibilities of its senior management, effective January 1, 2025. The implementation of structural reforms is a prerequisite for proceeding with the business integration.

In reviewing the capital relationship with France's Renault, a long-standing issue for Nissan, the two companies agreed to keep their shareholding ratios equal at 15%, with Renault placing 28.4% of its shares in trust. Nissan has been buying up more trustee shares, but this is a burden in merger negotiations.

Honda's and Nissan's sales for fiscal year 2023 were 20.4288 trillion yen and 12.6857 trillion yen, respectively, but their market capitalizations are more than four times greater than those of Nissan. As Nissan's performance was sluggish, management risks were increasing as funds increased their purchases of shares and Taiwan's Hon Hai Precision Industry Co. also extended its influence.

Following the news of the business integration talks, Nissan shares hit a daily limit on the Tokyo Stock Exchange on the 18th, while Honda shares fell from the previous day's closing price, resulting in mixed results. While hopes are growing for Nissan, which is experiencing poor performance, that it will be rescued, concerns are growing at Honda about its deteriorating profits.

With the two companies' positions differing, attention is focused on how the post-merger management structure and investment ratio will determine who will take the lead.

The impact of the merger will have ripple effects throughout the industry.

According to a survey by Tokyo Shoko Research, Honda and Nissan have a combined total of 23,440 business partners, roughly half of Toyota Motor's 48,130 companies, and there are fears that these business partners will be significantly affected if the restructuring of production systems and other measures take shape.

In the restructuring of the auto industry, DaimlerChrysler has been derailed, and Europe's Stellantis also saw its president resign due to sluggish sales. With few success stories, the question is whether they can produce results.

China Launches Offensive with Intelligence and AI

"In China, EVs are a complete extension of smartphones," said a Japanese automobile industry insider, describing the characteristics of the Chinese market. In addition to a "cool" vehicle exterior, Chinese consumers are looking for three things: entertainment value provided by large touch screen monitors, and cost-effectiveness.

In particular, Japanese manufacturers such as Nissan and Honda are lagging behind local manufacturers such as BYD in the area of vehicle intelligence and artificial intelligence (AI). The development of an operating system (OS) that can provide integrated control like that of a smartphone is still in its early stages, which means that over-the-air (OTA) and SDV, which allow software updates via communication, have not yet been realized.

Japanese automakers were supposed to make profits from the steady sales of hybrid vehicles (HVs), and use the profits to fund SDVs and electrification. However, the Chinese government imposed subsidies and regulations on the automobile industry, and created an EV market. As a result, Japanese manufacturers have been unable to keep up with the trend toward electrification and have been unable to grasp market needs, forcing them to downsize their businesses or withdraw from the market.

There is a limit to how much an individual company can do to make a comeback. Nissan's joint venture in China has announced a partnership with Huawei, a major Chinese telecommunication equipment company, while Toyota has also announced a partnership with Tencent, a major Chinese Internet company. In order to continue making huge investments in in-vehicle operating systems, SDVs, and even autonomous driving in the long term, collaboration and business integration are essential, regardless of the partner.