Automotive Parts Industry: Turning External Pressures into Opportunities for Transformation

The automotive parts industry is facing drastic changes in its external environment, including U.S.–China trade friction, increased tariffs, the shift toward electrification and software-defined vehicles (SDVs), and growing investor demands for improved capital efficiency. In addition to short-term profit pressures, the simultaneous progression of geopolitical risks and technological innovation is forcing companies to fundamentally review their supply chains and business structures. For the auto parts industry, turning these external pressures into opportunities for structural reform will be crucial to ensuring future growth.

- Toyota Strengthens Japanese Manufacturing: New Vehicle Plant in 14 Years Secures 3 Million-Vehicle Capacity and Supply Chain

- Nissan’s Bold Restructuring Plan: Cutting Costs and Aiming for Growth

| Advertisement | |

Strong Investor Pressure on Management Reforms

(1) Profit environment hit hard by increased tariffs

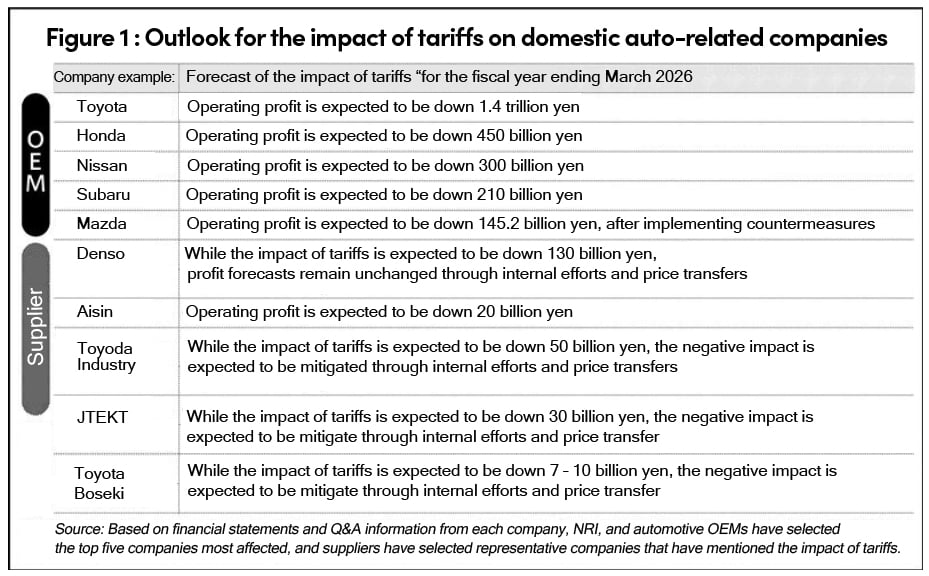

In addition to prolonged U.S.–China trade friction, tighter U.S. tariffs are having a major impact on the entire automotive supply chain. Reports indicate that a general agreement has been reached in Japan–U.S. tariff negotiations to set tariffs on U.S. goods at around 15%, including existing rates. Although this represents a reduction from the 27.5% level that took effect in April, it remains significantly higher than the previous 2.5% rate and continues to weigh heavily on domestic manufacturers’ profitability.

According to financial results from several major automakers, full-year forecasts as of Q1 FY2025 show that tariff impacts could reduce operating profits by approximately ¥1.4 trillion for Toyota and ¥450 billion for Honda. Parts suppliers plan to pass these additional costs on to customers, but negotiations with automakers are challenging amid inflation-driven increases in material, labor, and logistics costs — making short- to medium-term profitability difficult to secure. If this profit decline continues, it could trigger a fundamental review of corporate management and accelerate industry restructuring (Figure 1).

(2) Investor pressure and accelerating structural reforms

Beyond responding to geopolitical risks and technological innovation tied to electrification and SDVs, the automotive industry now faces increasing investor pressure to improve capital efficiency. Since 2023, the Tokyo Stock Exchange has been urging companies to adopt “management that considers capital costs and stock prices,” and is continuously monitoring progress. Meanwhile, shareholder proposals and activist involvement in capital policies have increased both domestically and abroad. As cross-shareholdings continue to dissolve, external demands for management reform can no longer be ignored.

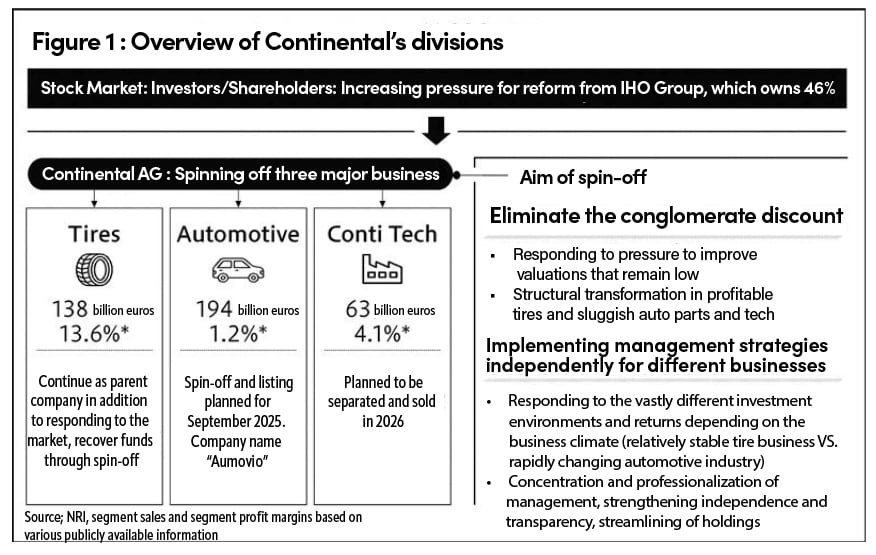

Continental AG, a major German supplier, is a symbolic overseas example. To enhance capital efficiency and focus investment in growth areas, the company decided to spin off its three main divisions—Tire, Automotive, and ContiTech—each with distinct business characteristics. Continental will retain its Tire division as its core business, while spinning off Automotive in 2025 and ContiTech in 2026. The restructuring responds to investor concerns about its sluggish stock price and the need to eliminate the “conglomerate discount” through independent management and focused strategies for each business (Figure 2).

In Japan, reports of a takeover bid and privatization of Toyota Industries Corporation have drawn attention. The move is believed to aim at redefining roles within the group, accelerating decision-making, and concentrating resources in growth areas. Similarly, the planned integration of Hino Motors and Mitsubishi Fuso appears to be part of a restructuring initiative led by Daimler AG. Within the Toyota Group, efforts to unwind cross-shareholdings and establish cooperative relationships independent of capital ties are accelerating.

Identifying a Vision to Strengthen Corporate Value

(3) Structural reforms and required actions

In this environment, parts suppliers must not only improve operational efficiency but also pursue bold structural reforms such as developing core technologies and expanding into new business domains. Given the current uncertainty, it is essential for management to articulate a clear medium- to long-term growth vision. The ability to determine “what to discard and what to focus on” will define corporate value. Companies will be tested on their agility in adapting to external changes and implementing forward-looking strategies.

Rising geopolitical risks also offer opportunities to optimize regional production and sales systems. In the U.S., “America First” policies are reshaping supply chains; Europe is strengthening self-sufficiency through the Carbon Border Adjustment Mechanism (CBAM) and related legislation; and in Asia, Japanese manufacturers are diversifying beyond China by expanding into India and ASEAN nations. It is critical to optimize financial and operational systems across these three regions, streamline overlapping functions, and establish flexible management structures tailored to each market.

Strategic Investment for Medium- to Long-Term Growth

(4) Growth policy and focus areas

Beyond structural reform, what should automotive suppliers prioritize for sustainable growth? Three key directions emerge:

1. Electrification and mobility sophistication

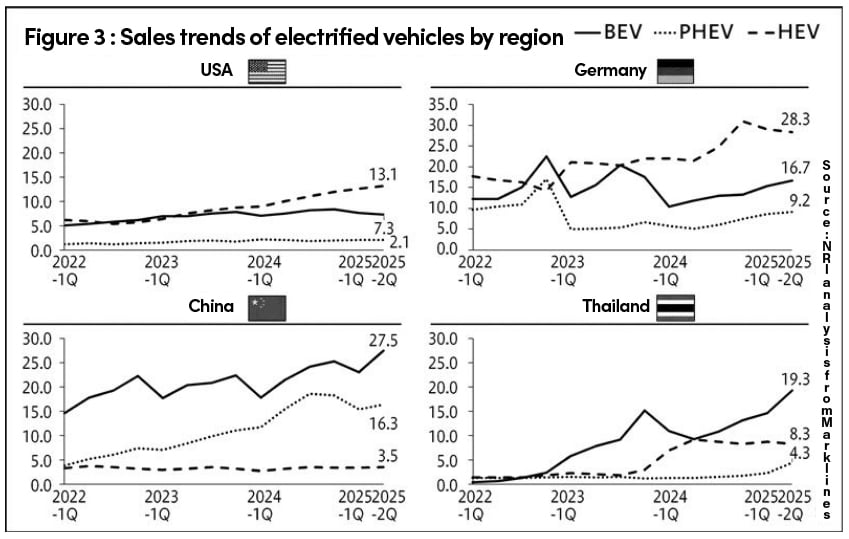

While BEV adoption in the U.S. may slow due to weaker Tesla sales and reduced incentives, global momentum—especially in China and Europe—remains steady. Autonomous driving (robotaxis, AD/ADAS) is also expanding, led by U.S. and Chinese initiatives such as Waymo’s multi-state rollout and Tesla’s 2025 robotaxi launch in Texas. Japanese manufacturers, supported by strong hybrid (HEV) sales, are encouraged to reinvest profits into power electronics, software control, and high-precision sensor technologies to secure future competitiveness. (Figure 3)

2. Circular economy and sustainable supply chains

Building circular supply chains—using recycled materials, remanufacturing parts, and reducing CO₂ emissions throughout the lifecycle—is becoming essential for meeting European regulations and ESG goals. Understanding carbon footprints (CFP) and ensuring parts traceability are now baseline requirements for leading automakers, making continued investment in sustainability infrastructure a long-term priority.

3. New fields around mobility

Opportunities are emerging in adjacent sectors such as energy (charging infrastructure, storage systems, hydrogen utilization) and robotics (AGVs, humanoid robots). Suppliers should assess where their strengths in mechanics, electronics, and control can be leveraged. Collaborations with software and SaaS partners can accelerate new business model creation.

As the automotive industry redefines roles and builds partnerships beyond capital ties, suppliers overly dependent on traditional automakers or in-house production risk losing future opportunities. Clearly defining a company vision and strategically allocating resources to key areas will be essential. Ultimately, transforming today’s environmental and external “headwinds” into tailwinds for reform may determine which companies thrive in the next generation of mobility.