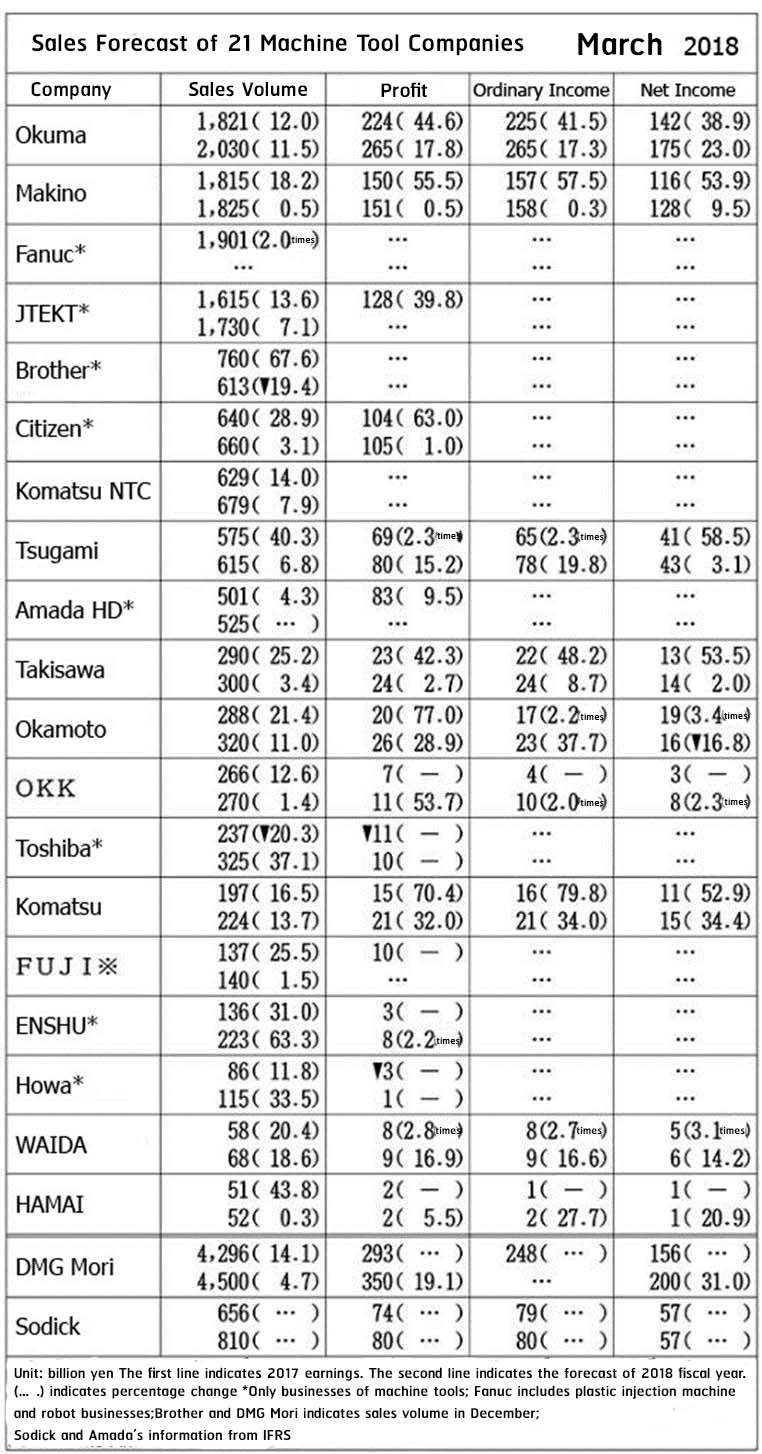

2018 Annual Sales Forecast of 21 Japanese Machine Tools Companies

The annual forecast of 2018 fiscal year of 21 Japanese machine tools finds that the effect of the delivery delay caused by the part shortage and high material price would have a dramatic impact on the revenue expansion. Despite there were companies’ forecast of good earnings growth due to high orders following the global machine demand, there were some companies’ forecast of a slight growth caused by two factors i.e. parts and materials calculated with market uncertainty in the second half of the fiscal year (October 2018 – March 2019).

Those companies with the forecast of the record high sales volume consisted of Makino, Citizen Holding, Tsugami, and others. On the other hand, Yoshimaro Hanaki, Chairman of Okuma mentioned that the company’s sales volume had reached 200,000 million yen in 11 years while Toshiba Machine expected its large machine would return the profitability, and Howa expected the return of its profitability after the 5 years of loss due to the demand from the automotive industry in Japan.

Brother Industries expected the decrease of its total sales volume when Chairman Toshikazu Koike said “It is reflected in our confirmed orders” and saw it as partially caused by the decrease of the machine demand for smartphone manufacturing. One of other companies with the same forecast was JTEKT, of which Chairman Agata Tetsuo opined that “the machine demand in the second half of this fiscal year would decrease from the previous year.”

However, Shinichi Inoue, Chairman of Makino, thought that “the second half of the fiscal year is still uncertain” and there was a concern toward the part procurement problem as well as the effect from the US-China relations, which caused Tsugami unable to forecast China’s market situation and therefore maintain the company’s second half market situation. Chairman Takao Nishijima said that “it is possible that the sales volume may be either worse or better, depending on the part procurement.”

Nowadays, the problems of the major parts and important parts have caused higher prices, followed by higher cost. The important problem is how companies would increase their product prices or develop quality of operation in order to remain their profitability.