Toyota's Move Could Reshape the Steel Market

The stable market price of hot-rolled steel sheets is poised to decline. Toyota's decision to reduce prices of automotive steel materials supplied to parts manufacturers for the first time in seven years has raised concerns in the hot-rolled steel market.

| Advertisement | |

Japan, September 2, 2024 – Concerns over price decline for hot-rolled steel sheets, Toyota-supplied materials cut for first time in seven years. Despite the unexpected price cut, the market remains calm.

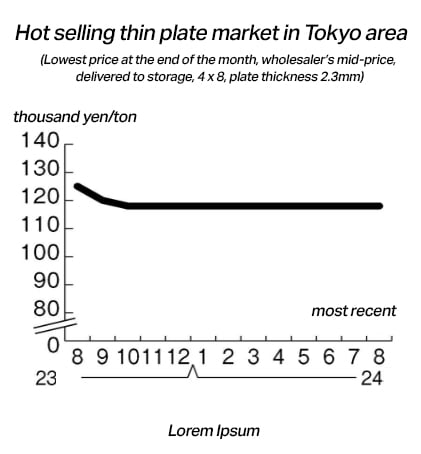

The market price of hot-rolled steel sheets, which has been stable, is likely to start to fall. Toyota Motor Corporation has decided to lower the price of automotive steel materials (supplied materials) it supplied to affiliated parts manufacturers for the first time in seven years, since the second half of fiscal 2017 (October 2017 to March 2018). Distributors, who expected prices to remain stable, were surprised and concerned by the price cut. On the other hand, Toyota’s suppliers are taking the price cuts for supplied materials in a calm manner.

Toyota will reduce the prices of supplied materials it supplies in second half of fiscal 2024 (October 2024 to March 2025) by about 15,000 yen per ton from the first half of fiscal 2024 (April to September 2024). As a result of the price reduction, the price of hot-rolled coil, a representative product, will be about 141,500 yen per ton.

One of the reasons behind the decision to reduce price is thought to be fluctuations in raw material costs, average contract price for coking coal from January to June, during which both prices were on a downward trend.

The prices of materials supplied by Toyota are reviewed every six months. After negotiation with steel manufacturers such as Nippon Steel, the company purchases steel materials in bulk and wholesales them to affiliated parts manufacturers at discounted prices. The company raised prices in the second half of fiscal 2022 (October 2022 – March 2023), but have remained them unchanged for three consecutive half-years since the first half of fiscal 2023 (April – September 2023) due to factors such as the price of main raw materials, energy costs, and labor costs. Given these circumstances, many distributors in the Kanto region had expected prices to remain unchanged in the second half of fiscal 2024, and some expressed surprise, saying, “I never thought they would lower them.”

Given the large volume of Toyota's material purchases, its pricing decisions will significantly impact future market fluctuations. One distributor expressed concern, saying, “We had anticipated price deductions given the recent number of inquiries and other factors, but now that the reductions have become a really, we can’t help but worry about the impact they will have in the future.” However, it is said that it is not possible to predict when or how much the price will fall, so it seems that we will need to continue to closely monitor the scope of the impact.

In contrast, several suppliers who do business with Toyota are more calm about the situation. The price reductions for materials supplied to Toyota are basically reflected in the prices that parts manufacturers deliver to Toyota, so “even if unit prices change, it doesn’t have a big impact,” said an executive at a parts processing manufacturer.

On the other hand, Toyota has indicated its intention to pass on increased costs to customers, and while parts prices are expected to fall, “the passing on of labor costs and other costs to customers is permitted,” according to an executive at a parts manufacturer. Another parts manufacturer also analyzed the situation, saying, “We raised steel plate prices too much, which has caused the price competitiveness of our parts to decline.

#Toyota #Automotive #Mreport #ข่าวอุตสาหกรรม

Source: Nikkan Kogyo Shimbun