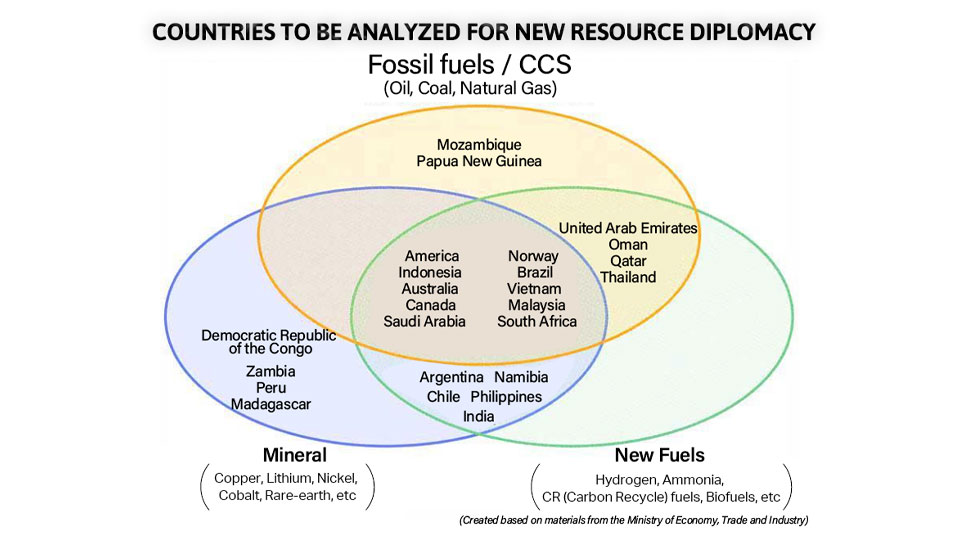

Resource Diplomacy Altered by Decarbonization, New Fuels, and Important Minerals

The global trend toward decarbonization is compelling a restructuring of resource diplomacy. In addition to fossil fuels and mineral resources, new elements like hydrogen and carbon capture and storage (CCS) have revolutionized the approach to resource-rich countries.

In response, the Ministry of Economy, Trade and Industry (METI) has devised the "Guidelines for Resource Diplomacy with an Eye on Green Transformation (GX)". For resource-poor Japan, this issue directly impacts the economy and industry, demanding urgent implementation of concrete measures.

Rise of Hydrogen Energy in Chile and Beyond:

The positioning of resource-rich countries has evolved, with Chile serving as a prime example. As the world's largest producer of copper and the second-largest producer of lithium, Chile has long been deemed a crucial mineral resource country for Japan. However, its abundant solar radiation and wind power potential have recently drawn attention, positioning it as a renewable energy powerhouse.

An official from the Agency for Natural Resources and Energy, the Chilean government emphasizes, "With the inclusion of renewable energy, our international standing is bolstered." The strategy targets the establishment of a system by 2030 and aims to be one of the top three hydrogen exporters by 2040. Subsidies will be provided for green hydrogen plants to stimulate private investment.

In southern Chile, several countries are actively promoting "hydrogen diplomacy". The German government collaborates with entities like Porsche and Siemens in the "Hal Oni" project, producing synthetic fuel from hydrogen derived from wind power generation. It is imperative to reevaluate Chile's status as a resource-rich country, now encompassing both minerals and clean energy.

On a contrasting note, the Chilean government unveiled a strategy in April to advance state-controlled lithium development, indicating inclinations towards resource nationalization. Lithium, vital for batteries and government security, is gaining paramount importance. Ichiro Kutani, research director of the Institute of Energy Economics, Japan, underscores that essential mineral resources, not just lithium, "will become a source of new geopolitical risks as a stable supply becomes indispensable in the spread of clean technology."

Japan's Guidelines for Deepening Ties:

In light of these shifts in resource diplomacy, the guidelines crafted by the Ministry of Economy, Trade and Industry target an analysis of 25 selected countries. Categorizing them based on domestic situations and relations with Japan, they are divided into groups such as "comprehensive partner countries" and "environmental improvement countries," with specific resource diplomacy approaches tailored for each group. For "traditional stable supply countries" like Chile, Japan will continue securing conventional resources while expanding into new fuel sectors.

Saudi Arabia falls under the same category of "traditional stable supply countries" as Chile. Leveraging its historical ties with mineral-rich Africa, Saudi Arabia aspires to become the nexus of the mineral supply chain, connecting Africa to the global market. This necessitates scrutiny of Japanese trading companies, according to an executive from the Energy Agency. As a leading global oil producer, it presents a different facet and demands a fresh approach. The comprehensive partner countries include the United States, Australia, and Canada, collaborating to establish new market rules and develop technology related to new fuels for expansion into third countries.

Minister of Economy, Trade and Industry Yasutoshi Nishimura, who recently visited five African countries, emphasizes, "Rather than mere investment, we aim to establish mutually beneficial relationships with resource-producing countries and secure mineral resources through Japan's distinctive comprehensive support, including human resource development, technology transfer, and infrastructure development."

In the face of escalating competition for important minerals due to the global decarbonization trend, resource diplomacy capitalizing on Japan's strengths is imperative now more than ever.

Interview with Mr. Hiroki Sadamitsu, Director General of Resources and Fuels, Agency for Natural Resources and Energy, Ministry of Economy, Trade and Industry:

Purpose Behind Formulating the Resource Diplomacy Guidelines:

“Up until now, resource diplomacy primarily centered on securing stable supplies of oil and natural gas from regions like the Middle East. However, now it is imperative to secure new fuels alongside fossil fuels. Simultaneously, there's a surge in demand for minerals. The shift towards reducing fossil fuel consumption necessitates electrification, heightening the importance of storage batteries. Rare metals, indispensable for storage batteries, are also crucial for electric vehicle (EV) motor magnets and hydrogen utilization. We must adapt to the structural changes from fossil fuels to new fuels and from energy to minerals.”

Continued Significance of Fossil Fuels:

“Given the current climate of divestment from fossil fuels, jeopardizing procurement security, we must approach fossil fuels with even greater caution. Under these circumstances, the guidelines incorporate a chronological framework, including which countries are of paramount importance to Japan and when specific fuels will be needed.”

Inclusion of Economic Stability Perspective:

“Recognizing the risks associated with over-reliance on a specific country for supply chains, it's imperative to address these vulnerabilities. Governments worldwide are focusing on decarbonization in part to safeguard their own industries and employment, intensifying the competition for industrial policy. Future resource diplomacy must account for this.”

Exclusion of China from the Selected 25 Countries:

“China's inclusion was based on its role as a supplier to Japan. China is not in a position to supply energy. The guideline also takes into consideration the investment interests of Japanese companies, which is why Russia is not included. However, China remains a critical supplier of rare earths. Given the high level of dependence on China, the guideline includes a policy of continuing reduction while treating it as a special case outside the framework of the 25 selected countries.”

Concrete Policy Development Based on the Guidelines:

“We aim to secure suitable sites for CCS in conjunction with fossil fuels. In response to CO2 emissions during natural gas production, discussions have commenced in Australia to make CCS mandatory for gas production. CCS will play a pivotal role in obtaining fossil fuels. Concerning new fuels, support measures will be devised to incentivize Japanese companies to take a lead role in the emerging market of Sustainable Aviation Fuels (SAF). Additionally, there are plans to add biofuels to the list of supported targets of the Japan Energy and Metals National Corporation (JOGMEC).”

Mineral Resources:

“The competition, particularly for minerals used in storage batteries, is fierce. There's a risk that the supply of such minerals may not keep up. We must seamlessly cover each stage of development—early, middle, and late. Collaboration with automobile and battery manufacturers is essential to acquire interests.”

#Decarbonization #NewFuels #Hydrogen #RareEarth #Japan #Mreport #ข่าวอุตสาหกรรม

Source: Nikkan Kogyo Shimbun