Mitsubishi Fuso and Hino Motors Near Final Merger Deal, Key to Southeast Asia Strategy

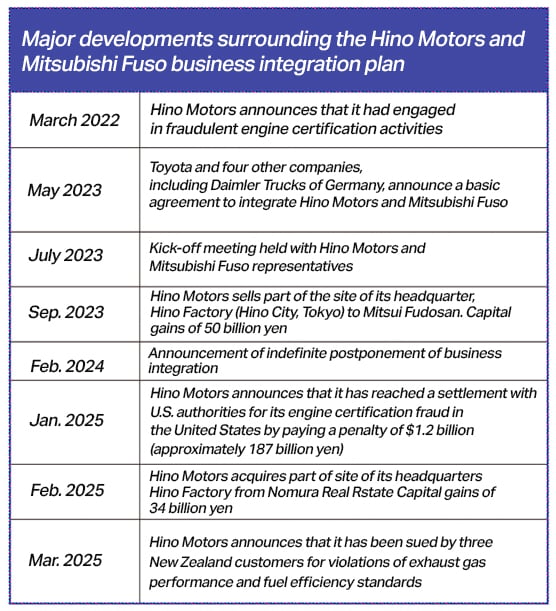

Mitsubishi Fuso Truck and Bus Corporation and Hino Motors are expected to reach a final agreement on their long-awaited business integration—almost two years after the initial announcement in May 2023. The deal, which had been postponed indefinitely due to Hino’s engine certification fraud, is back on track now that compensation issues have been largely resolved.

However, significant hurdles remain. These include protectionist trade policies from a second Trump administration in the U.S., a slowdown in core Asian markets, and overlapping business segments. Overcoming these obstacles is crucial to unlocking the full benefits of the merger.

Spotlight on Indonesia

“It’s difficult to make up for the lost time. Chinese manufacturers have gained significant ground in Southeast Asia,” an industry insider noted.

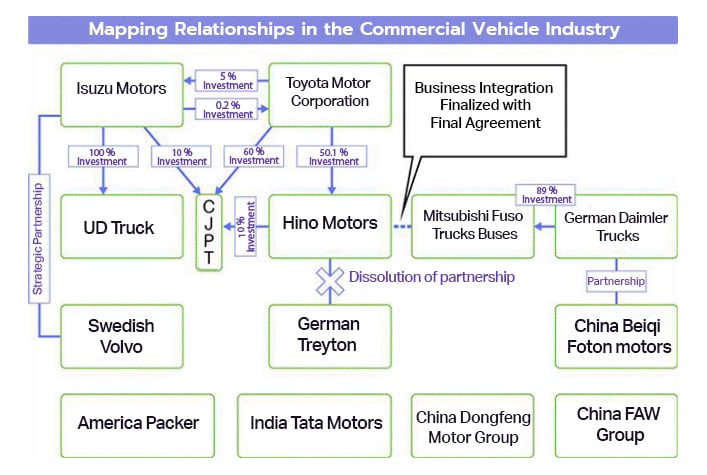

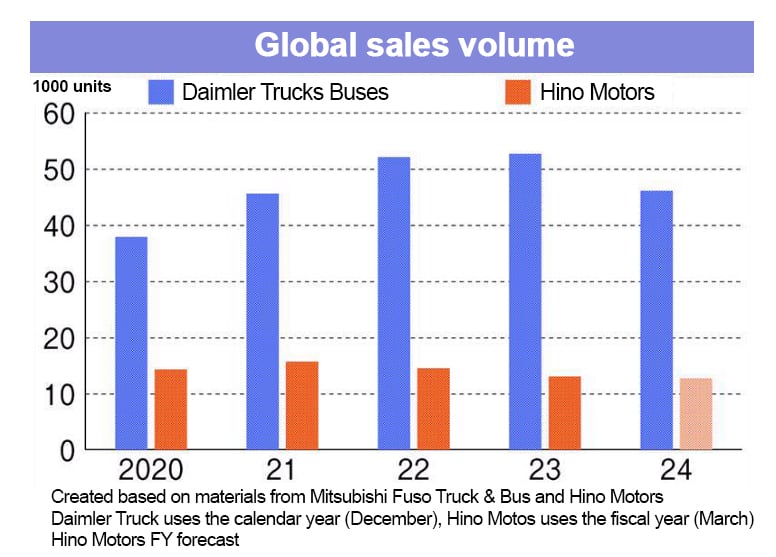

Initially, Mitsubishi Fuso and Hino planned to finalize the merger by the end of fiscal year 2024. Their respective parent companies—Germany’s Daimler Truck and Japan’s Toyota Motor Corporation—would jointly establish a holding company listed on the stock exchange, with both truck makers as subsidiaries. Hino sold 130,200 units globally in FY2023 (company announcement), while Mitsubishi Fuso sold 61,500 units in FY2024 (MarkLines). Combined, the entities would be worth roughly 2 trillion yen in annual revenue.

The integration was indefinitely delayed in February 2024 as regulatory reviews and fallout from Hino’s scandal continued. Meanwhile, Chinese automakers are making inroads into Southeast Asia, traditionally a stronghold for Japanese firms. Success hinges on whether the merged company can retain and expand its share in markets like Indonesia, where Hino generates about 40% of its sales. A decline here could jeopardize the company’s financial foundation.

Together, Hino and Mitsubishi Fuso held 75% of Indonesia’s truck market in 2024. Mitsubishi Fuso leads in small trucks, while Hino dominates the medium-duty segment. Once a battleground among Japanese brands like Isuzu, the market now sees growing Chinese competition.

In July 2024, FAW Jiefang Automotive (part of China’s FAW Group) announced a 1,200-unit truck deal with a major Indonesian logistics firm. The company has also pushed a “15333” strategy to promote new energy vehicles (NEVs), including fuel-cell vehicles (FCVs), and recently introduced China’s first hydrogen direct injection engine for large trucks.

In December 2024, another Chinese player—Beiqi Foton Motor—opened a plant in Thailand. Reports suggest some Chinese trucks are entering Indonesia without type certification or registration, priced 2–3 million yen cheaper than certified rivals.

The return of the Trump administration, favoring fossil fuel policies, has further disrupted EV market momentum. Hino’s President, Satoshi Ogiso, emphasized urgency in an interview with Nikkan Kogyo Shimbun: “Even a strong player like Isuzu is adapting by collaborating with UD Trucks and Volvo. Mitsubishi Fuso and Hino can’t do this alone. We need to move forward quickly.”

Rationalization Is Key

Where are the synergies? According to Seiji Sugiura of Tokai Tokyo Intelligence Lab: “The merger could bring gains in efficiency, R&D, and market expansion—similar to how Isuzu and UD Trucks jointly developed products. It’s better to face Hyundai and Chinese rivals together than separately.”

To unlock synergies, the companies must streamline overlapping operations—especially in diesel engine development and domestic sales networks. In May 2023, they pledged to collaborate in vehicle development, procurement, and production. If Hino can reduce the development costs of large diesel engines (including those impacted by the certification scandal), the benefits will be substantial.

But deeper integration—such as sharing chassis platforms and rationalizing 500+ domestic dealerships—will be critical. Realizing these gains will take significant time and effort.

Decarbonization and Future Mobility

Looking ahead, success will depend on navigating the transition to new energy vehicles. The broader alliance—Toyota, Daimler, Hino, and Mitsubishi Fuso—could be a strategic asset.

While FCVs are considered ideal for trucks, EVs also remain in play, depending on infrastructure rollout. Toyota, maker of the Mirai FCV, is developing a hydrogen truck system and partnering with U.S. truck giant Paccar. Though progress has slowed under U.S. fossil fuel-friendly policies, hydrogen tech remains vital to long-term decarbonization.

Daimler, strong in EVs, received an order for over 200 e-Actros 600 trucks from Amazon in January 2025. It launched a new EV brand, Rizon, in the U.S., which Mitsubishi Fuso supplies. In Europe, Daimler plans to build 3,000+ fast-charging stations by 2030.

The commercial vehicle sector has changed dramatically in just two years. Whether this integration delivers depends on how quickly Mitsubishi Fuso and Hino can adapt, align, and execute under the shared vision of their global parents.

Source: Nikkan Kogyo Shimbun