Thailand's Automotive Industry Outlook 2019

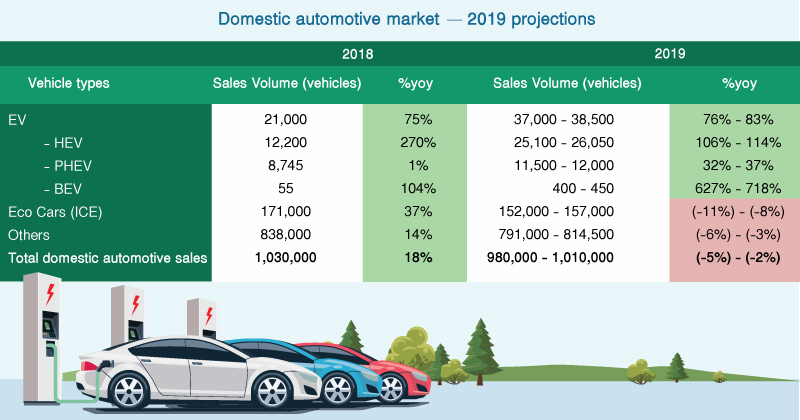

Thailand's domestic automotive market will likely contract while the electric vehicle segment continues to thrive

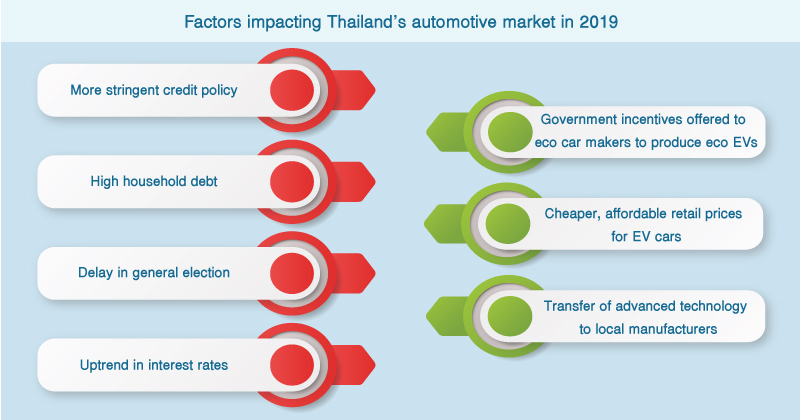

The global automotive industry is shifting focus towards electric vehicles (EVs), partly due to tightening regulations as tougher emission duty guidelines are set in major economies like the US, Europe and China. Several countries including Germany, Norway and India, are planning to phase out sales of diesel and gasoline powered vehicles. While oil price in 2019 is expected to linger at a relatively high level, government bodies are encouraging EV production via incentives and tax reductions. In alignment with this wave, the Thai Finance Ministry reduced excise tax rates for EV cars since 2017, driving domestic sales of hybrid electric vehicles (HEVs), battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs). This trend will likely continue into 2019 despite the expected decline in the overall domestic automotive sales.

Thailand’s automotive export market will experience gradual growth in 2019

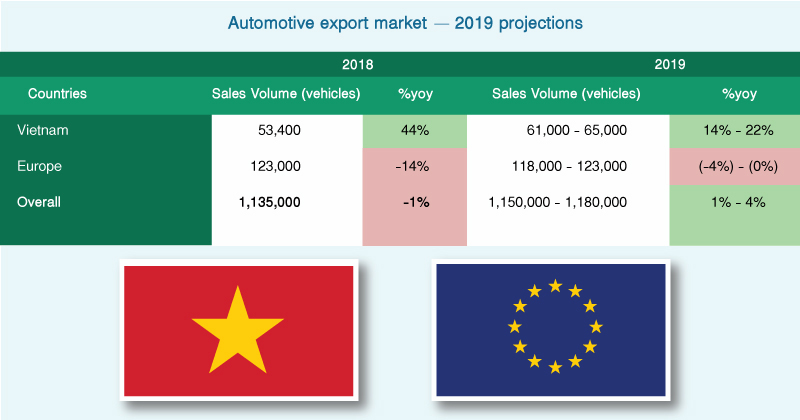

Thailand’s auto export growth has outpaced domestic sales, making up approximately 60% of Thai automotive sales. In 2019, Thailand’s auto export volume growth is projected to grow gradually by 1-4% pressured by global economic slowdown and relocation of production base to countries in Europe. However, auto export volume to Vietnam is expected to grow notably by 14-22% in 2019 spurred from high demand for Thai automobiles and it is considered a high potential market in 2019 due to:

- The ease of import restricting regulation imposed under Decree 116

- Relocation of passenger cars manufacturing base into Thailand for auto products to be re-exported back to Vietnam

- Higher average income among the Vietnamese population

- More affordable small engine eco cars, amid high oil price in Vietnam.

On the contrary, Thai auto export to Europe will be pressured by the relocation of production bases to countries in the region, nearer to end consumers, in an effort to reduce logistics and transportation costs. These include countries like Hungary, Netherlands, France and Finland, for instance. Emission controls in Europe will also contribute to the reduction in Thai auto exports to the region. Lastly, the United States-Mexico-Canada Agreement (USMCA) will come into effect from 2020 onwards, which will tighten control over where the vehicles are originally manufactured from. This would potentially slow down Thai auto export to the membership countries. Thailand can limit the negative impacts by ramping up production and exporting EVs to Europe and USMA member countries, which heavily promotes EV adoption.

Government incentives for EV producers will be a key driver to speed up the level of adoption in Thailand

In conclusion, Thailand’s overall automotive sales are expected to be weak in 2019 from the contraction in the domestic market and the sluggish export volume growth. Meanwhile, high growth in the EV segment will continue to support the industry. Hence, the Thai government is persistently trying to encourage the manufacturing of EVs and high-tech auto parts through promotion of BOI incentive packages. In 2018, the government approved projects to produce HEVs and batteries by Nissan Motor Co and Honda Motor Co valued up to US$888 million (THB 28 billion). Meanwhile Mazda Motor Co was granted investment privilege to manufacture HEVs and has decided to apply for production of full EVs in Thailand. Many other manufacturers also plans to invest and are studying for possible opportunities or are in the process of application for the BOI package. EV segment still contributes very little to Thailand’s automotive market, but we can expect a ramp up in production and an increase in adoption over the next few years.